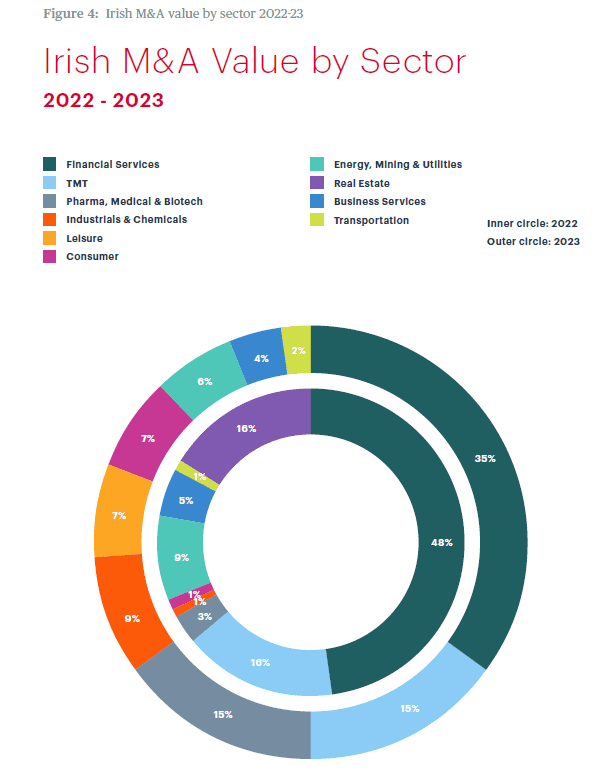

In value terms, Ireland’s financial services sector recorded more M&A activity than any other industry during 2023 (Figure 4).

In fact, this was the second consecutive year in which it topped the rankings, though the proportion of deal value for which the sector accounted – 35% – was down on last year’s figure of 48%.

The sector played host to the largest deal of the year, the €3.3bn acquisition of Pembroke by AviLease, as well as AXA’s €650m purchase of Laya Healthcare. But a series of smaller transactions were also spread across the mid-market, in sub-sectors ranging from insurance to corporate finance.

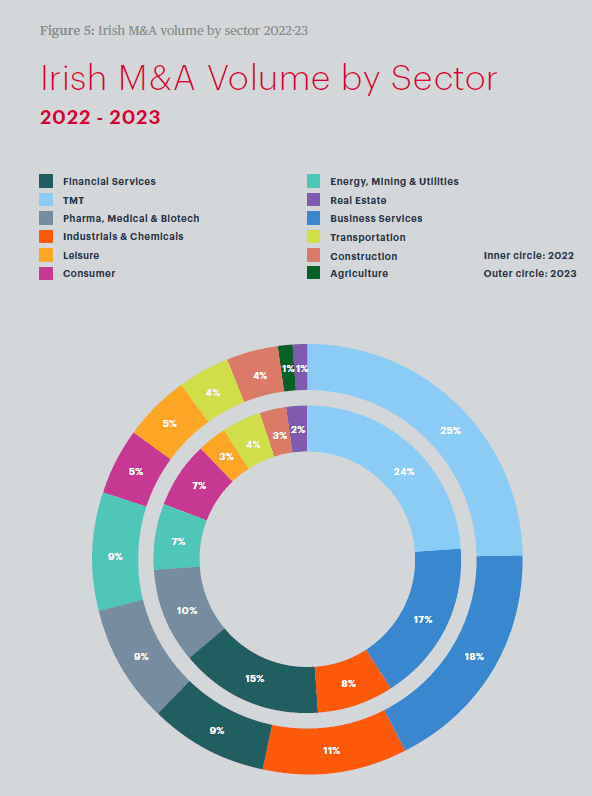

In deal volume terms, the leader in Ireland in 2023 was the TMT sector, which accounted for 25% of transactions announced (Figure 5). Still, while TMT was also the busiest sector of the market in 2022, it has slipped back slightly compared to last year in value terms, from 16% of deal value then to 15% in 2023.

Indeed, while lots of technology deals are still being done in Ireland, many of them are small, specialist transactions; the top 20 M&A transactions of the year included only five TMT plays. HR software maker UKG’s €575m acquisition of Immedis, a payroll platform provider, was one exception, but larger TMT transactions were few and far between. The travails of the technology sector globally, where valuations on listed markets worldwide have fallen back over the past 12-18 months, appear to be having an impact.

That said, the digital transformation imperative should not be overlooked. Technology renewal is an ongoing theme of M&A across the Irish market, even where deals do not involve pure-play TMT companies.

Tied with TMT in total deal value terms in 2023 was Ireland’s PMB sector, also with 15%, though it achieved that mark on a smaller volume of transactions, accounting for 9%. The industry continues to experience large deals, including Chiesi Farmaceutici’s €1.3bn purchase of Amryt Pharma, and the €216m swoop on Spinal Stabilization Technologies by BlueRiver. But there is also significant activity at the smaller end of the PMB market, where Ireland’s thriving biotech ecosystem continues to attract attention from international buyers.

Smaller deals dominated in the business services sector, where 18% of M&A activity by volume in Ireland took place during 2023, up marginally from its 17% share in 2022. Ongoing consolidation in services such as accountancy and consultancy is an important part of the story, but there has also been interest in sub-sectors such as outsourcing.

Another sector worthy of mention is energy, mining and utilities (EMU), which accounted for 6% and 9% of M&A in value and volume terms in 2023. As Ireland, like other countries, takes steps to confront its climate change mitigation responsibilities, interest in the energy-transition theme continues to increase. As a result, there were notable deals involving renewable energy over the year, including Arjun Infrastructure Partners’ €300m acquisition of Amarenco Solar, and the €150m purchase of JOLT Energy by joint bidders Sun Life Financial and InfraRed Capital Partners. Further transactions in the renewable energy sub-sector are expected over the course of 2024.